Auto Enrolment

By 2018 all employers must automatically enrol their eligible employees into a pension scheme – known as Auto Enrolment.

Every company will receive a staging date, which is a date by which the scheme must become active. The individual dates are phased across the year so it can be managed. The larger companies were the first to stage and as we move closer to the final deadline small businesses are being sent their staging date.

Choosing the type of pension scheme for your business is fairly straight forward, however, the compliance and ongoing administration of the Auto Enrolment scheme is often underestimated.

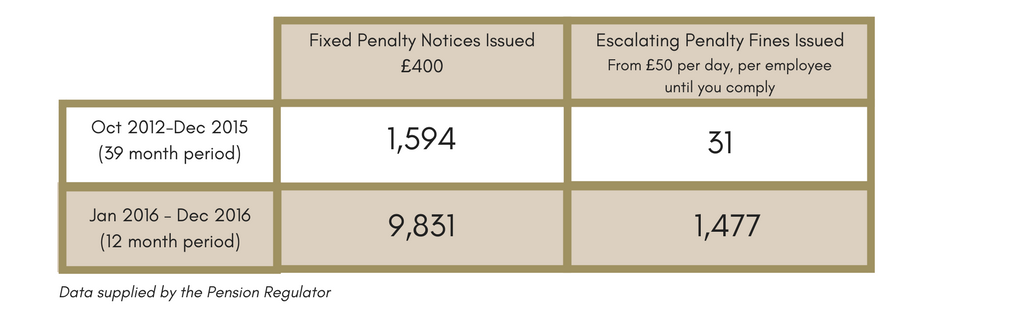

The Pension’s Regulator has different penalties in place which affect small businesses that do not have the resources to prepare for them.

The table below shows a 516% increase in £400 fines in one year and over a colossal 46,000% increase in escalating fines in the same 1 year compared to the previous 3. These are mainly small businesses on which these fines have a large impact.

What is Postponement?

The company staging date (go live date) cannot be changed. Postponement relates to your duty to assess your workers, this can be delayed by up to 3 months.

You must inform all workers in writing that there is a new company pension scheme even if they are not eligible for Auto Enrolment.

Understanding the term ‘Eligible Workers’

By law, it is the employers’ responsibility to prove which workers should not be included in the scheme. Should you be challenged you must be able to prove that any self-employed staff, under contract, are not ‘workers’ under the EU definition. It is not enough to just say they are self-employed.

If they are found to be a worker they will have to be auto enrolled and the Employer will have to make good any back payments… as well as the appropriate fine!

The onus is on the employer to ensure each worker is regularly reviewed to see if they are now eligible for Auto Enrolment. This should be carried out on every payday; therefore it is more cost effective to have a monthly salary.

Employees most affected by this are seasonal workers and those who are turning 22.

The company must keep records of Auto Enrolment for a minimum of 6 years.

Our Support

Our Independent Financial Advisers can help you plan your Auto Enrolment and take the stress out of the on-going administration. We can work directly with your business and in conjunction with your Accountant to:

- Advise on a pension plan

- Provide a communication template to update your employees

- Managing the Continuous Compliance

- Run workshops to inform employees and answer questions on the scheme

- Advise on a low maintenance continuous compliance system

If you would like more information read our Auto Enrolment Article in Insights or Contact us.

The Financial Conduct Authority does not regulate Workplace Pensions